capital gains tax rate 2021

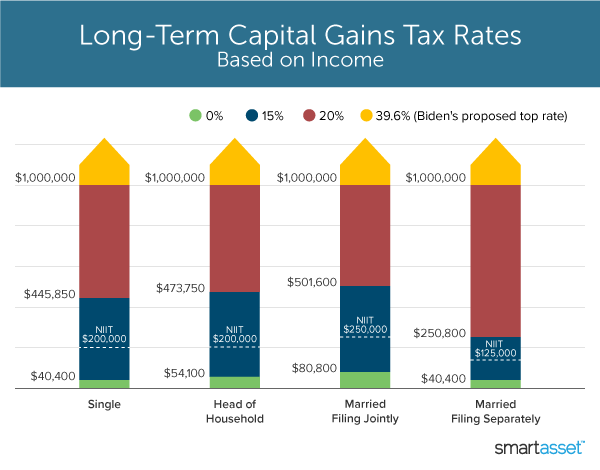

Long-term capital gains are taxed at only three rates. Add this to your taxable income.

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

Wisconsin taxes capital gains as income.

. There are other rates for specific types of gains. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax.

Return to index CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF SHARES OF STOCKS NOT TRADED THROUGH THE LOCAL STOCK EXCHANGE Tax Form. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35. The rate of CGT is 33 for most gains.

In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single tax filers with taxable. Theyre taxed at lower rates than short-term capital gains. Type of Tax.

The tax rate on most net capital gain is no higher than 15 for most individuals. Long-term capital gains are gains on assets you hold for more than one year. 2022 capital gains tax rates.

40 for gains from foreign life policies and foreign investment products. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. 0 15 and 20.

Oregon taxes capital gains as income and the rate reaches 99. Because the combined amount of 20300 is less than 37700 the. Tax year 2021 File in 2022 Personal income and fiduciary income Long term capital gains Dividends interest wages other income.

Rates would be even higher in many US. 2021-2022 Capital Gains Tax Rates Calculator. Depending on your regular income tax bracket your.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to. Tax Rate For real property - 6. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

Long-term capital gains taxes are assessed if you sell. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Meanwhile for short-term capital gains the tax brackets for ordinary income taxes apply.

Long-term capital gains taxes apply when you sell an asset at a profit after. Small business exclusion of capital gains for individuals at least 55 years of age of R18 million when a small business with a market value not exceeding R10 million is. Long-term capital gains can apply a.

5 days ago Feb 24 2018 2021 capital gains tax calculator. 18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work. In 2021 and 2022 the capital gains tax rate is 0 15.

Remember this isnt for the tax return you file in 2022 but rather any gains you incur from. The following Capital Gains Tax rates apply. 2021-2022 Capital Gains Tax Rates.

How to Calculate Canada Capital Gains Tax in 5 Steps. That means you could pay up to 37 income tax depending on your federal income tax bracket. Adjusted Cost Base ACB The adjusted cost base ACB is the.

In the US short-term capital gains are taxed as ordinary income. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding. Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to.

The New Washington State Capital Gains Tax Rate Shoeboxed

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Short Term Vs Long Term Capital Gains White Coat Investor

What S In Biden S Capital Gains Tax Plan Smartasset

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax What Is It When Do You Pay It

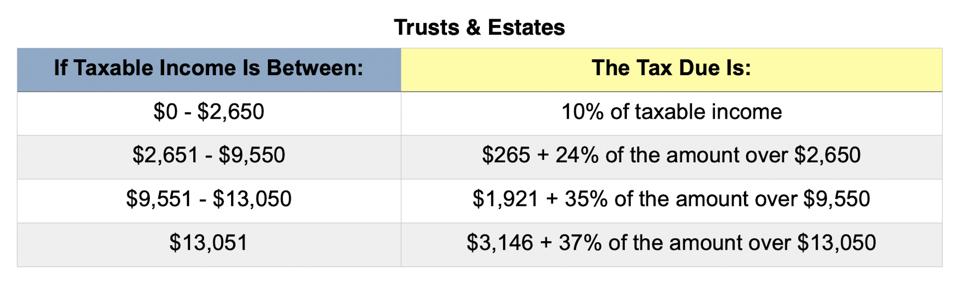

2021 Tax Rates Quick Reference Guide Tax Brackets Tax Tables More Tax Pro Center Intuit

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Estate Legacy And Long Term Care Planning Center Of Western Ny

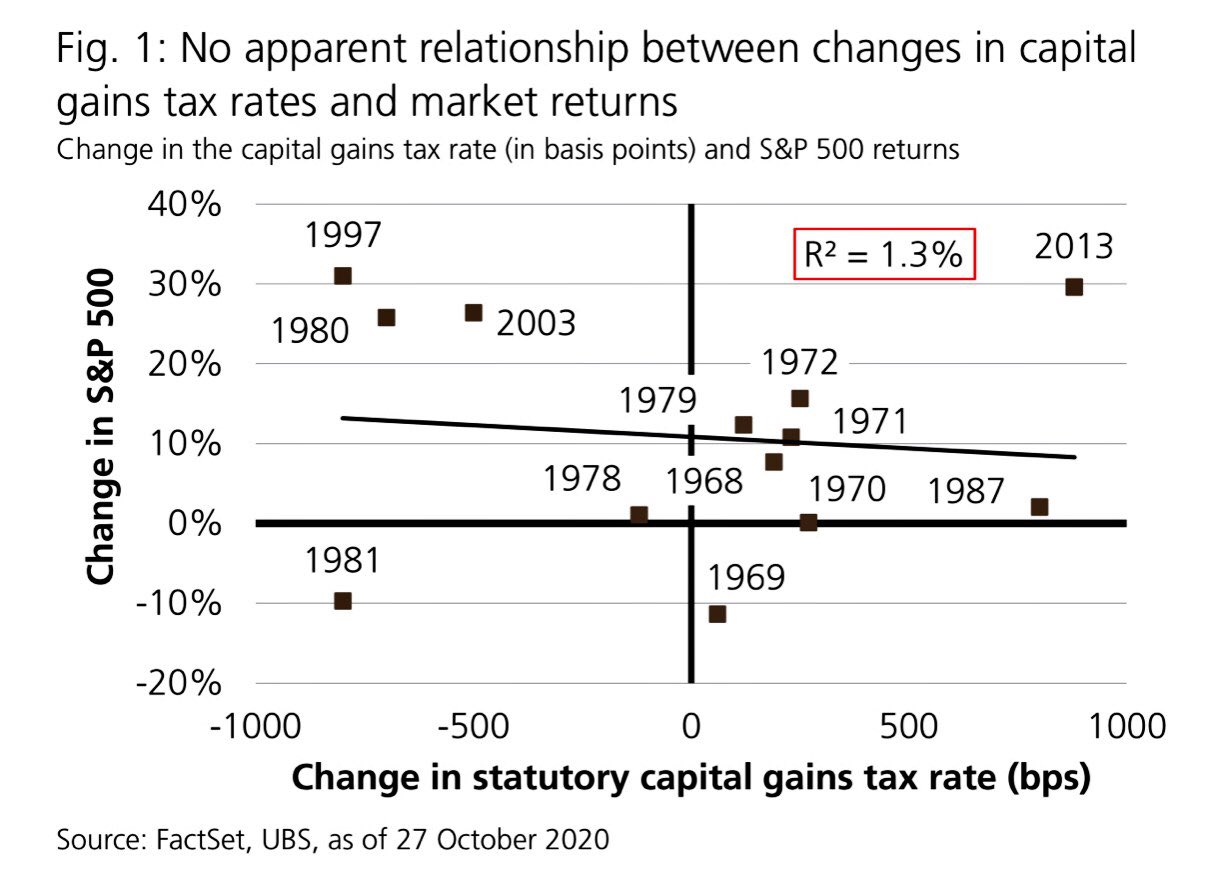

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Archives Skloff Financial Group

Understanding The Tax Implications Of Stock Trading Ally

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

2022 Income Tax Brackets And The New Ideal Income

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Full Report Tax Policy Center

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe